The rental market is in an unusual state. On one hand, the current economic climate has priced many potential first-time buyers out of the market in a two-pronged fashion, with the cost of living crisis making it harder to save the necessary deposit and other associated costs of buying. Additionally, mortgage rates and terms are not as attractive as they were even a year ago and this shows no sign of abating in the coming months.

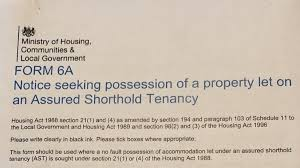

First-time buyers need to not only save their deposit but also legal fees. They will also need to fund a building survey London or in their chosen location. The net effect is that there are now far more potential tenants around, but it is reported that they are finding it increasingly difficult to find suitable properties. Landlords are having to cash in their assets, rents are increasingly unaffordable, and the risk of section 21 no-fault evictions looms large.

So are there any towns and cities where investing in a buy-to-let is a shrewd move? In a word, yes. With the increasing demand for rental properties suitable for first-time buyers to live in until the housing and mortgage markets normalise, this could be an excellent time to source the right property in the right location.

Where to buy?

Logically, the places to target are those where buying a first home is most challenging, London being a prime example. Of course, the increased costs of purchasing here are also felt by potential investors, and with high property values, it is even more important, for example, to arrange a building survey in London. There are a number of additional hotspots to investigate, and areas where commuting into the City is feasible, such as Brighton.

Several university towns also offer prime buy-to-let markets, with Oxford, Cambridge and Bristol all providing a ready market of early career academics and professionals as potential tenants.

Where to avoid?

Conversely, there are a number of towns where house prices are far more achievable on average salaries and, therefore, easier for first time buyers to move out of rental properties. Several such areas are in Lancashire, with Preston, Burnley and Blackpool all potentially being locations in which the supply of tenants may be more limited. Mansfield and Middlesbrough also feature prominently in a summary which was collated by using salary data and the house price index produced by the Land Registry.

In summary, the demand for rental property is high and likely to remain so for quite some time, until the economy and housing market recover and the cost of living crisis abates. However, the shrewd buy-to-let investor, assuming they have minimal restrictions on the location in which they wish to buy, would do well to study the data and focus on areas where buying a first home is most challenging. The demand will be much higher in these locations than those where buying a starter home remains relatively achievable.