How do you know when the time is right for you buy a property? Here are some important things to consider when looking to buy a home:

Your Finances

This must be the single biggest factor when deciding whether the time is right to purchase a property. Home ownership is most likely the largest single purchase you’ll make in a lifetime, so it’s not a decision to be taken lightly. Ask yourself if you have enough money saved to afford a deposit, ideally at least 20% of the asking price. You’ll also need to consider if you easily afford the monthly payments of a mortgage. Try to think of future payments and not just the current state of your financial health.

Your Financial Future

Thinking ahead is another important step in deciding whether to buy a property. If you have recently changed jobs, looking for another job or expect any changes to your income in the future, you should hold off until you are more certain how the land lies. Most mortgages can only be obtained if you have been with an employer for more than one year, so this is another thing to consider. You’ll need to have a contingency in place in case anything goes wrong in the future. What if you’re made redundant or have a period of long-term sick leave? Before buying a home, it’s important to have emergency funds available as well, for worst case scenario situations.

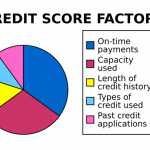

Credit Score

It’s a good idea to check your credit score before seriously considering buying a home. Your credit rating will determine whether you are accepted for a mortgage and what rate you’ll be offered. A lower score will result in a higher interest rate, meaning you’ll pay far more in the long-term. If your score is lower than you’d like, spend some time trying to improve it by paying off debt, checking your report for any mistakes, making all your payments on time and avoid applying for further credit.

A big commitment

Be prepared for a lot more responsibility when you’re a homeowner. If you’ve previously only rented, then being responsible for all repairs and maintenance can come as a shock. Some people love having these chores as a part of owning a home but for others, they would rather someone else took responsibility. Knowing whether you’re ready for such a commitment is another decision to make before putting in an offer on a home. If you decide renting is for you, then consider Gloucester Lettings Agent and visit Gloucester lettings agent Alex Clark

Remain in one place

If you have a desire to travel the world or are not sure you’re ready to settle in one area, then now might not be the best time to buy a property. Unless you intend to stay in your home for a while, you won’t make any money from selling it. With all of these costs, it is very difficult – if not impossible – to make money on a home unless you plan to stay in it for a while. Experts have suggested that a period of between 3-5 years at least is necessary if you want to buy a house.